- Conscious Commerce

- Posts

- 🟣 Issue No. 76: Wild

🟣 Issue No. 76: Wild

How Wild sold to Unilever after raising under £10m

wellness commerce insights

$100M BRAND STORY

Wild: the Refillable Deodorant Brand that Scaled Fast, Stayed Lean, and Sold to Unilever

Wild is a London-based personal care brand that started with a refillable natural deodorant and has recently expanded into wider bathroom products. The core mission stays simple: remove single-use plastic from the bathroom and offer natural formulas that feel design-led and “mainstream-ready” rather than worthy or niche.

From an idea at Pizza Express in 2019, Wild reached eight-figure revenue (£12.5m) in its first full year of trading, grew over 400 percent in 2021, and sold millions of units across multiple markets. By 2023 the brand hit roughly £46.9m in sales and its first pre-tax profit. In April 2025 Unilever bought Wild for a reported £230m, with the founders said to have netted close to £100m while keeping Wild as a distinct brand inside a global portfolio.

Are They Funded or Bootstrapped?

Wild started with scrappy angel money, not big VC cheques.

Key beats.

2019 MVP phase: Freddy and Charlie bought off-the-shelf natural deodorant, rebranded it, and ran an early Shopify test. That test drove around £100k in revenue and, more important, gave hard CAC and price data.

Initial raise: After an early term sheet collapsed, they pieced together roughly £500k from angels across the London DTC network. That process took around six months and relied heavily on introductions from other founders.

2020-2021: With that money they launched the refillable Wild deodorant in April 2020 and used performance marketing to scale while keeping the team tiny.

2022 funding: Wild closed a £5m round led by JamJar (the Innocent Drinks founders’ fund), with other investors joining. At this point total capital raised reached about £7.5m.

Wild sits in the “modestly funded” camp.

Enough money to build their own tooling, support retail launches, and move into new markets, without loading up on cash they did not need. Freddy often talks about the risk of big rounds at high multiples. They set aggressive expectations and push founders toward unhealthy burn.

Their Origin Story

The idea did not start with deodorant.

Freddy met Charlie in a Pizza Express to talk about “sustainable fashion” before both admitted they had no style and should avoid that category. That conversation shifted them to a more analytical question:

Where do households use products every day and throw away large amounts of plastic that rarely gets recycled?

Through Charlie’s side business, Climate Cups, and consulting work with various DTC brands, they saw:

Sustainability-focused brands produced strong social engagement and shareability.

Consumer concern about packaging waste had spiked, especially during Freddy’s time at HelloFresh. Pack complaints climbed from non-existent to one of the top reasons for churn.

They analysed different rooms in the home.

Kitchen: already crowded with eco brands.

Fashion: wrong skills and little genuine interest.

Bathroom: high plastic use, low recycling, and minimal innovation.

The bathroom data points that shaped their thesis.

A large share of household plastic waste comes from the bathroom, and recycling rates stay low because packaging uses mixed materials and most people have a single general bin there.

Deodorant stood out as both high frequency and boring. Ads skewed either dull for women or macho for men. That left a space for something colourful, playful, and gender-neutral.

From there the idea sharpened:

Build a refillable format with an aluminium case and compostable refills.

Match or beat mass-market efficacy so people never feel they traded down for sustainability.

Wrap everything in a brand that feels fun, colourful, and highly shareable.

That early MVP with poor product quality nearly sank them, but it did three useful things.

Proved people would pay for a natural deo solution.

Delivered real CAC data.

Created a tiny cohort of early adopters who stayed loyal through future iterations.

Core Customer Base

Wild sells to a broad audience, but the core is:

Gender: Skews female. Freddy describes Wild as “a female brand” even though the range is officially gender-neutral.

Age: Largely 20s to 40s. Digital-native shoppers who live on Instagram and TikTok and are comfortable with subscription or repeat online orders.

Values: Care about health, ingredients, and plastic waste, but still prefer convenience and aesthetics over activist messaging. They want the bathroom shelf to look good and smell good.

Behaviour:

Replace deo regularly, often multi-purchase households.

Mix channels: DTC for special cases and scents, mass retail for top-ups.

Engage with limited drops, seasonal fragrances, and collab designs.

A key insight from the founders: the brand serves mainstream consumers first and eco-purists second. In the ICONS interview, Charlie explains that if someone buys Wild only because they like the design or scent and does not care about sustainability, that still supports the mission because each purchase replaces single-use plastic.

How Did They Grow So Sustainably? (P&L View)

1: Start with CAC and LTV discipline

During their COVID launch window in 2020, Wild acquired customers for roughly £2 on Facebook, which is absurdly low by today’s standards. Instead of letting that period trigger aggressive spend, they treated it as a window to:

Prove channel product fit for paid social

Gather data on subscription take up and reorder cadence

Refine price and offer structure with real cohorts

Their team found that a few patterns stood out:

Subscription plays a key role but never carries the whole model. It sits alongside new scents, limited edition cases, and wide retail availability as one LTV lever.

The team watches payback periods closely and stayed wary of “growth at all costs”. Freddy often talks about the risk of taking large rounds at 7–8x revenue, because those deals bake in years of flawless execution and push founders toward unhealthy burn.

2: Lean team, aggressive outsourcing

Wild scaled to multi eight figure revenue with a small internal team, roughly 30 employees after about £7.5m raised.

Tactics.

Hire slowly, often slightly behind demand, and accept short term stretch instead of building a 50 person org on £5m of revenue.

Use agencies and freelancers for tech, selected marketing, and parts of operations, then scale that support up or down based on performance.

Keep revenue per head high by focusing internal hires on brand, performance, product, and key retail relationships.

A similar pattern appeared at Native in the US, which reached around $30m in revenue with about eight full time employees at exit.

3: Multi-channel, multi-geo by design

Wild never treated DTC as the only path. Channel strategy assumes a simple trade. Either pay acquisition costs to Meta or accept retailer margin with Tesco, Sainsbury’s, and others. Once CAC sits inside the DTC margin stack, retail net contribution often looks stronger.

Key moves.

Launch DTC first to build the brand, collect reviews, and prove product market fit.

Enter UK retail once awareness and repeat behavior existed. Wild now lists in Tesco, Sainsbury’s, Boots, Ocado, and Target in the US.

Expand into Europe early, with Germany estimated at roughly three quarters of UK revenue.

Treat DTC as the marketing engine that creates demand and retail as the convenience channel that catches that demand, not as two separate businesses.

4: Relentless product iteration

Wild is now on at least the fifth iteration of its deodorant formula. Early versions did not perform well. The team launched early to gather data, then improved for efficacy, texture, and glide.

The playbook.

Start with limited SKUs, roughly three cases and five fragrances at first.

Increase SKU count only after reorder patterns show clear winners.

Use feedback from DTC customers, Trustpilot reviews, and community input to guide formula tweaks and new scent development.

5: Profit focus before the exit

By 2023 Wild reported pre tax profit of about £509k on revenue of £46.9m. The business treated profitability as the primary objective that year, even at the expense of slightly slower growth. Reaching profit before a sale strengthens the case for a strategic buyer such as Unilever.

Key Milestones

Mid-2019: Concept and MVP development begins.

Early 2020: Closes £500k angel round.

April 2020: Official launch of the refined product, perfectly timed with the COVID e-commerce boom.

End of 2020: Raises £2M, hits ~£500k-£600k monthly revenue, team grows to 10.

2021: Expands into European markets, with Germany becoming a key territory.

2022: Surpasses £26M in annual revenue.

2023: Launches body wash in the world's first fully compostable and plastic-free liquid container—a 2.5-year R&D project.

Their Influencer Marketing Mix

Wild’s influencer strategy is organic and community-driven rather than a high-cost, celebrity-led play.

Micro & Macro-Influencers: They partner with a wide range of influencers in the wellness, sustainability, and lifestyle spaces who authentically align with their mission.

The Founder-Led Channel: Both founders are active and relatable voices on LinkedIn and other platforms, building trust and brand affinity within the business and operator community.

The VIP Group (The Ultimate Community Lever): Their masterstroke is a 10,000-strong VIP customer group. These superfans provide a constant stream of user-generated content (UGC), offer feedback on everything from scents to packaging, and act as a powerful, organic marketing army. This turns customers into collaborators.

Their Marketing X-Factor

For operators, the most interesting thing about Wild is how intentionally “un-eco” the brand feels on the surface while still delivering strong environmental outcomes.

Core elements.

1. Sustainability as a feature, not the headline

Wild bakes sustainability into product and packaging from day one, while leading with scent, design, and convenience in the story. That focus helps the brand win with shoppers who want something that smells good, feels good, and looks good on the shelf, with lower plastic use as the rational bonus.

2. Turning the dullest product in the bathroom into a talking point

Deodorant sits in a flat, low-interest category. Wild treats that as an opportunity.

The response:

Loud colour palette, confident type, playful tone

Limited editions and collabs that feel like drops, not routine FMCG launches

UGC-friendly design that makes people want to show cases and scents on social

3. Entertainment-led performance marketing

Wild runs brand and performance as one system. Creative aims to trigger emotion and memory first, then paid media follows up to convert.

In practice this looks like.

Thumb stopping, slightly offbeat creative in social ads

Creator-led storytelling instead of heavy brand voice

Performance spend going behind content that feels like top-of-funnel entertainment but still sells

4. Multi-channel story with one visual language

Every touchpoint looks and feels consistent. The case seen on TikTok matches the one in Tesco or Target. That consistency builds recognition fast. Shoppers spot the product on shelf before reading any copy, which lifts conversion in retail as awareness from social carries straight into store.

Takeaways for Wellness Operators

Here are practical lessons you can apply to your own brand.

1. Treat sustainability as infrastructure, not as your only message

Build product and packaging on a strong sustainability base.

Lead with outcomes that shoppers feel every day: taste, texture, scent, design, convenience.

Let sustainability sit as the “rational reason” underneath an emotionally appealing brand.

2. Use MVPs to buy data, even if the product is imperfect

Wild’s first natural deo was poor, but that run delivered real CAC and pricing data and unlocked the first angel round.

Your MVP’s job is to prove demand and direction, not to win awards.

Protect your early customers with upgrades, transparent comms, and strong retention offers.

Ask “would someone show this on their bathroom shelf on Instagram or TikTok”.

Make colour, naming, and form factor bold enough that a product shot carries.

Encourage UGC early, then recycle it into performance ads once you see what hooks.

4. Keep the org lighter than feels comfortable

Resist the urge to hire ahead of revenue.

Use agencies and freelancers for non-core functions and judge them strictly on contribution margin impact.

Track revenue per head and treat it as a health metric.

5. Treat DTC and retail as one system

Use DTC for testing, storytelling, and high-intent customers.

Use retail for scale and convenience once the product works.

Compare contribution margin after marketing for DTC vs wholesale margin, not gross margin vs gross margin.

6. Go multi-geo earlier than your comfort level

A second or third market gives you fresh pockets of growth when your home market matures or competitors appear.

Europe is not one market. Localise language and shipping but keep the brand spine consistent.

7. Keep profitability on the table, even in high-growth phases

Wild hit profit before a strategic exit, with modest funding and a lean team.

Treat each raise as optional fuel, not a badge of honour.

Build a plan where your business survives even if the next round never arrives.

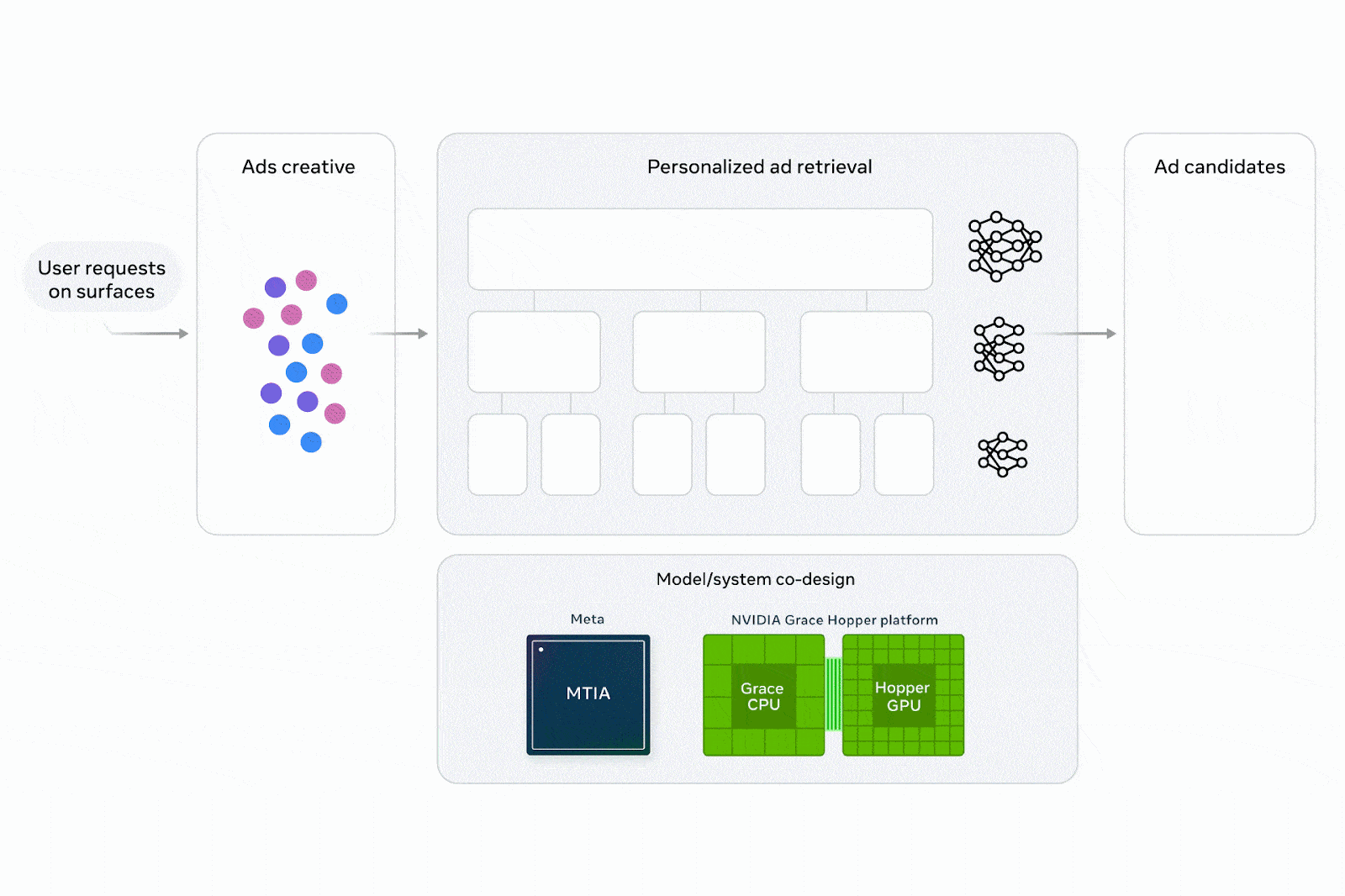

How to Win With Meta’s New Algorithm (The Andromeda Playbook)

If your Meta Ads performance suddenly dipped, you’re not alone.Meta just rolled out one of its biggest algorithm updates ever — Andromeda.

This isn’t a tweak or a small adjustment. It’s a complete rebuild of how Meta decides which ads get shown to which people.

Lately, there’s been endless chatter about the Andromeda update across social media — but a lot of it’s noise.

DTC Daily sifted through hundreds of posts and distilled what the top experts are actually saying into one clear, practical playbook that explains:

Why old “winning ads” die faster than ever

How Meta reads your creative for signals

The 4-Source System to generate infinite new ad ideas

Read the full Andromeda Playbook

-------------------------

This guest post was written by DTC DAILY. They share 3 bite-sized, curated strategies in each issue that you can implement today. If you found this tip helpful, subscribe to Dtc Daily

Interested in advertising?

Connect with our highly engaged community of Wellness Commerce operators and execs.